Blockchain, sometimes referred to as Distributed Ledger Technology (DLT), makes the history of any digital asset or transaction unalterable and transparent through cryptography. This form of cryptography allows for trackable and irreversible transactions where verification comes from the consensus of multiple sources. Prior to blockchain technology, transactions could only be verified by a central authority such as a company’s or a bank’s private database, vulnerable to hacking and data manipulation. The essential benefit of blockchain technology is that it creates a provable, corroborated, unchangeable history of data. Other benefits of integrating blockchain include:

- Reducing transaction fees and costs in a transaction as there will be less of a need for intermediaries and time spent on brokering transactions

- Transforming information flow through increased speed and transparency of transactions to enhance price discovery and secondary market liquidity

Currently, there are three prototypes of crypto assets (payment, utility and security investment tokens) on the market. Each of them is with specific business purposes, shareholders, and related regulatory frameworks. STO belongs to one of the encrypted assets, which is called the “Security Token Offering” in full, which is the issuance of security tokens. Just like an IPO, a STO is a regulated public offering. This means that STOs must comply with all legal frameworks for public offerings. STO must have assets as collateral, such as a set of real estate, a car, a membership card, a famous painting, a company, or even the stocks of intellectual property rights. All these can be represented by a STO. Among them, the use of blockchain technology to securitize assets in the form of virtual tokens, and the issuance, custody and settlement of traditional securities (such as stocks, bonds, etc.) or other illiquid assets (such as real estate, vehicles, foreign wine, etc.)

The security tokens issued by the programming integration of smart contracts and regulated by the Securities Law turn illiquid assets in the market into liquid assets and release their own value. Besides being the innovative new opportunity for fund raisers, STO also provides investors with a new option on asset allocation. According to a research published by Fidelity Investment in 2019, 47% of US institutional investors believe that crypto assets occupy a place in their investment portfolios. Institutional investors have better insights and opportunities than common investors. Being the initial group of insiders to understand crypto assets and participate in it, the potential and achievement can be comparable to those who have participated in the Internet and smart phones development era.

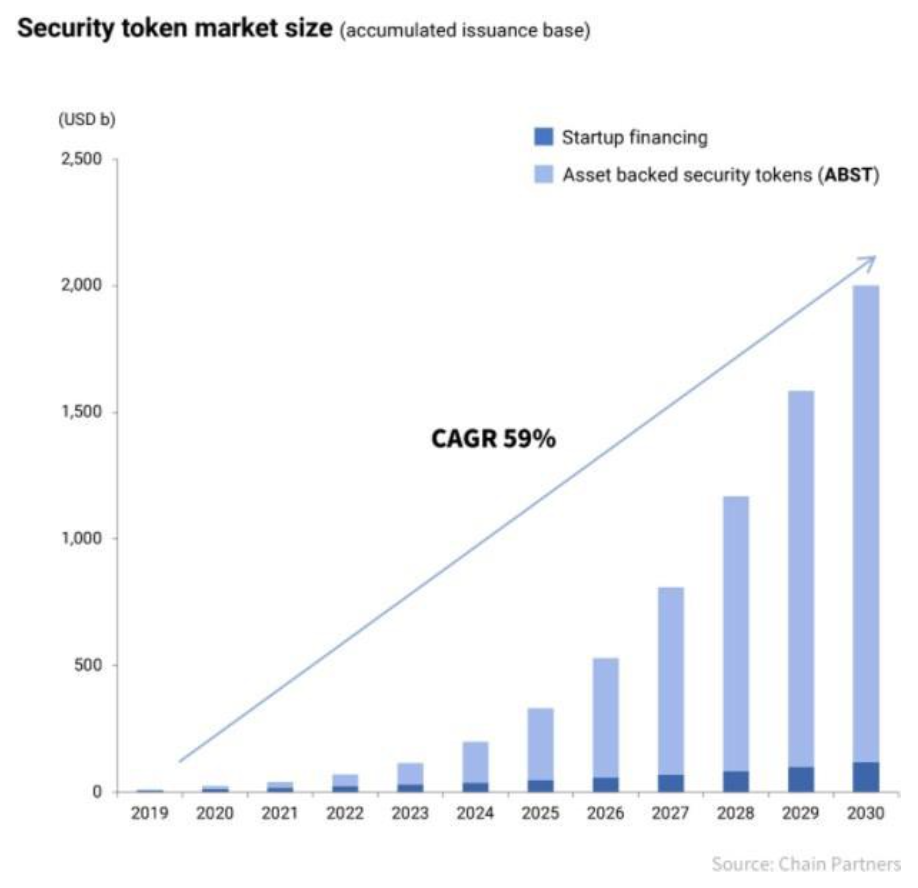

According to a recent research report by Opimas on the potentials of STO, about 30% of the fundraisings in the future will be conducted through STO. It is expected that the funds raised by STO will also rise from US$983 million in 2018 to US$2.67 billion in 2023. According to another report from Chain Partners, the cumulative issuance of the STO market will grow to 2 trillion US dollars by 2030, and the compound annual growth rate (CAGR) from 2019 to 2030 is 59%. Adrian Lai, the founder of STO blockchain technology platform Liquefy, pointed out that since STO is a new technology. Currently, some more avant-garde financial institutions are considering the introduction of STO. Furthermore, some real estate companies are paying attention to the potential of STO. It is believed that STO will be available in Hong Kong in 2-3 years.

The technology of security tokens, legal structure and secondary market are developing constantly. Security tokens can basically represent everything. Therefore, security tokens can also be used as payment tokens or utility tokens in theory. Therefore, the diversity of its functions enables issuers not only to rely on investors for financing but can also approaching potential customers for funding. Base on the above characteristics, STO is becoming more popular to the public.

We are now in a new era created by financial technology, for investors, the diversity, low threshold and high liquidity of securities token investments are favorable to asset allocation and promote vigorous development of crypto assets.

Diversified Risk

STO is not limited to financial products. Some alternative assets, such as wine, famous paintings, and antique cars, etc. can all be invested in securities tokenization, which can make the investment portfolio more diversified and not limited to financial products. At the same time, investing in alternative assets, due to its low correlation with traditional securities investment products, the risk of asset portfolios when facing financial crises can be greatly reduced. More protections are provided to the investment portfolio.

Flexible Investment Allocation

For example, in the debt and real estate market, due to the high investment threshold, a large number of people cannot participate in the investment. The market has accumulated 100 trillion US dollars in debt assets and 230 trillion US dollars in real estate assets which cannot be effectively circulated. However, STO investment thresholds are more flexible. Since STO splits the value of assets into equal number of shares of cryptocurrency or equity, investors can participate in a relatively high value investment. Thus, making appropriate asset allocations according to their own needs and increase investment flexibility. For example, a Monnet’s painting may be valued for 100 million US dollars, which is not affordable by most people. By applying block chain technology to divide the ownership of famous paintings into different equal shares under legal circumstances, investors can participate in the sale of famous paintings at a lower price.

Liquidity and Reduced Transaction Risks

Now some asset markets are lacking liquidity because the transaction processes involve high costs and procedures. Take for example, buying and selling properties, a lawyer is involved to follow up and assist in document preparations and executions. STO program smart contracts, interest, dividends and other content into securities and execute them automatically with the application of blockchain technology, which makes STO has advantages that traditional securities do not have such as real time trading and T+0 simultaneous clearing. STO is not restricted by time and place. Real-time transactions can be carried out anytime, anywhere with high transparency. Compliant trading can be carried out without complicated procedures. This has greatly improved the liquidation of assets. Since large sum of funding is injected into the STO market and compound annually, the liquidating ability has been greatly advanced. In addition, STO allows investors to cash out the assets through the secondary market, which the trading record and the ownership of assets are instantly recognized by using blockchain technology, transaction risks are reduced.

STO is a brand-new financial market. Seize this opportunity to benefit from the new technology in the era of tokenization. STO provides diversity, low threshold and high liquidity for investment portfolios, enhancing better asset allocations.

References:

- https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/technology/lu-token- assets-securities-tomorrow.pdf

- https://www2.deloitte.com/tw/tc/pages/risk/articles/finance-sto-challenge.html

3. https://www.edigest.hk/article/91858/%e7%86%b1%e8%a9%b1/%e9%87%91%e8%9e%

4. 8d%e7%a7%91%e6%8a%80-%e5%8d%80%e5%a1%8a%e9%8f%88-

%e5%8a%a0%e5%af%86%e8%b2%a8%e5%b9%a3-cryptocurrency-ico-sto-