Did you know that the Tokyo 2020 Olympics is not the only thing that had corporate Asia going agog all through the Summer of 2021? Security tokens have also become so popular across the Pacific, that large corporations and retail investors are falling head over heels to get a slice of the cake.

Combining the liquidity, security, and high-growth potential of Cryptocurrencies with the stability of commodity markets and the reliability of the stock markets, it’s no surprise that the market capitalization for Security Tokens grew by 500% in 2020. They have become more than just a fad in global finance, as many veritable digital exchanges such as CryptoSX (one of the pioneers of licensed and regulated Security Token Exchange, since 2018) have begun to provide security token offerings (STOs) to retail and institutional investors.

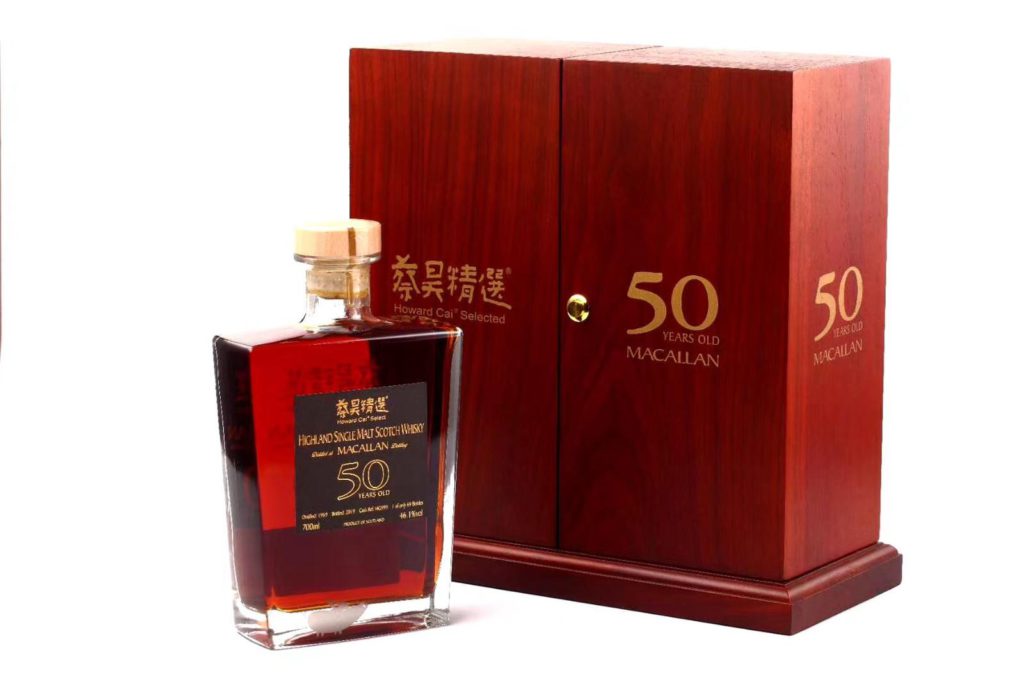

In 2020, HCS Whisky Segregated Portfolio Company (“HCS”) a world-leading private equity whisky fund, announced a partnership with Cryptosx Digital Asset Exchange to have their whisky-backed security token listed on the CryptoSX exchange platform. This partnership becomes one of the world’s first listings of Securitized DS protocol security tokens on a licensed exchange that supports both centralized and decentralized trading.

This partnership has since become highly lucrative for many Investors. Leading up to an increased demand for the HCS token especially among Asian & European HNIs.

In this write-up, you will learn about what the Whisky fund is all about, why it has such high-yield potential, and how you too can participate to get a portion of this liquid gold.

What is the Whisky Fund Security Token?

HCS is the first blockchain-enabled rare Whisky Investment Fund led by the legendary Howard Cai – a renowned whisky expert, and international food judge.

High entry barriers and low liquidity are challenges that have plagued the Whisky commodity industry for decades. Investment in barrels of Scottish Whisky has an extremely high entry Capital barrier. For instance, a single 1995 Macallan cask was recently sold in 2020, for over £240,000 in a Sotheby’s auction.

In addition to the Capital barriers, Investment in Whisky has perennially required in-depth industry networks and knowledge to identify and manage the barrel in bonds. Furthermore, converting such capital-intensive holdings into liquid cash often takes a costly and time-consuming process of listing or auctioning.

Tokenization has helped to surmount all of these challenges in one fell swoop. And with an overwhelming demand for quality alternative investment assets globally, HCS has taken the initiative to bet big on blockchain technology.

Today, Whisky enthusiasts and investors have turned towards blockchain technology to create a new method of investment that features virtual curation and fractional ownership of Whisky stock, collectibles, and valuables. Through tokenization, whisky investments that previously had huge requirements in terms of initial capital outlay, have now been brought to reach millions of retail investors by allowing them to buy tradeable units of the stock in form of tokens on the blockchain.

Why You Should Invest in The Whisky Fund Security Token?

Tokenization of Whisky-based assets like Casks and Collectible bottles, and Limited-edition spirits provides diverse opportunities for life-long Whisky enthusiasts to earn significant passive income from their passion.

With the listing of the HCS Whisky Security token on Cryptosx, Accredited Investors can now get access to the following opportunities;

1. High-Yield Potential

Over the last decade, investment in Whisky stocks and related assets has proven to be a reliable store of value. It is far less volatile than Oil and has significantly higher yield potential than other traditional assets like gold and the stock market.

For instance, in 2016, APEX 1000 Index reports were published by the industry observers, Rare Whisky 101.

Likewise, the value of Rare Whisky has grown +582% growth since 2009, significantly dwarfing the S&P 500 Index that recorded an Inflation adjusted growth of 338.63% over the same period.

Overwhelming statistics show that, Whisky as an alternative investment class significantly outperforms traditional investments like gold, oil and stocks and by a wide margin.

2. Diversification

Diversification is a crucial factor to consider when allocating funds to any asset class. The Whisky fund is unique in this regard as it contains multiple sub-classes of non-correlating assets. The Whisky funds expose you to gains across at least 3 different markets;

- Whisky Casks

- Bottled-Whisky

- Collectibles

Although they’re all subsumed under the term Whisky Fund, in reality, whisky casks, bottled whiskies, and collectibles are essentially separate markets.

The bottled-whisky market has significantly higher liquidity and lower barrier to entry and is more price-sensitive in comparison to Whisky Casks which are usually held for longer periods especially by HNIs.

Whisky Collectibles is another Whisky-affiliated market that has emerged in recent years. It refers to investment in old and rare bottles of Whisky that have significant sentimental and ornamental value to a growing community of collectors across the world.

All of these markets are driven by diverse and unrelated factors. Diversification is a major exciting feature that has attracted Investors to the Security token offered by HCS on CryptoSX. It effectively differentiates the Whisky market from other conventional commodities and traditional financial markets, that have very little discernible correlation.

3. Intrinsic Value

Like most assets in the commodities market, Whisky has an intrinsic value. With the most expensive luxury limited editions of the drinking costing millions of dollars per bottle. And quite significantly, it is a non-depreciating asset that literally gets better with time. In an interview with CNBC, Rupert Patrick, CEO of WhiskyInvestDirect famously stated that “Whisky gets better the longer you store it”. This underlines the intrinsic value of Whisky commodities as an investment vehicle.

4. Price Stability

Compared to other commodity markets, the Whisky fund is a far more reliable store of value. This is largely due to the Whisky Cask components of the Market.

Since the majority of cask beings are held by HNIs and wealthy families across the globe. This demographic is known to have the propensity for long-term hold power. This also puts whisky casks in the realm of alternative assets and luxury goods.

Furthermore, the long-term demand for bottled whisky is projected to exceed production for the foreseeable future, leading to fewer whisky casks flowing into the private market, further pushing up its prices and profit margins for Investors.

Practically, whisky casks and bottled whiskies can be treated as separate markets. The bottled-whisky market has significantly higher liquidity and a lower barrier to entry and is more price-sensitive in comparison.

5. Regulatory Compliance

Unlike other crypto assets, STOs such as the HCS Whisky fund are subject to stringent scrutiny by regional and international regulators. They provide the token owner with the rights to the assets promised by the security. AML/KYC considerations are strongly embedded in their processes. This helps to improve the credibility of the issuer in the eyes of banks, payment gateways, and fund managers, which will assist such regulated entities to comply with their own AML/KYC obligations.

6. High-Growth Potential in New Markets

The Whisky market in Europe and North America is well-established and mature. Major indicators show the Asian market has exponential growth potential, as the region’s appetite for rare whisky increases. According to a report published by Euromonitor, the value of whisky sales in China is projected to exceed 3 billion dollars by 2022. Showing a 38.6% more than in 2018, and the volume of whisky sales is to reach 23.65 billion liters in 2022.

Wrapping Up

Liquidity, Stability and High-growth potential – the HCS Whisky Fund Security Token Offering has all the makings of a valuable investment class.

By leveraging on the exponential growth and Liquidity that blockchain technology offers, HCS & CryptoSX effectively transforms Whisky into liquid Gold for Investors.

The only thing better than a high-yield asset class with one with significant growth potential. The best time to get on the Whisky Fund train was 10 years ago, the next best time is now. Click here to get started.