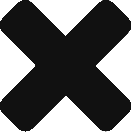

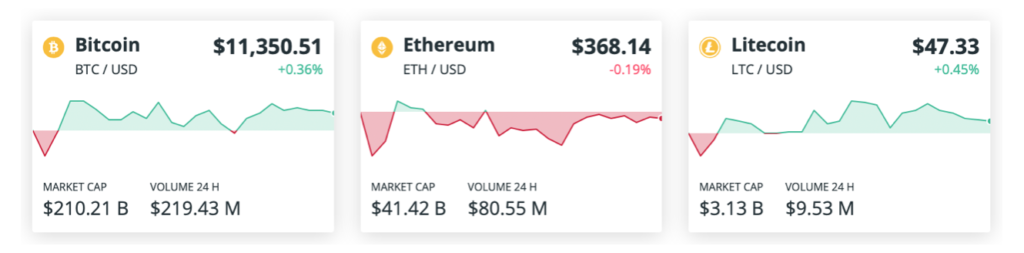

- BTC broke above the 11,500 resistance after moving up $81 overnight from its range-bound territory for the past four days.

- ETH trading $10 above 10D SMA currently (380 vs 370

- Suspension of Digital Assets/Cryptos withdrawal at OKEx

Bitcoin Price Is Stagnant Despite Recent News: The Calm Before The Storm?

Bitcoin (BTC) bounced off the $11,178 support on Oct. 15 but the bulls could not sustain the price above $11,500. This weakness could have attracted profit booking by the short-term traders and shorting by the aggressive bears.

The increasing volumes of crypto derivative products highlight greater participation from institutional investors and this will likely be positive for the entire crypto space.

In a separate attempt to determine the valuation of Bitcoin, several experts from JPMorgan Chase opined that Bitcoin’s price is overvalued compared to its intrinsic value and the analysts suggested that BTC could face selling in the short-term.

The bears are currently attempting to sustain Ether (ETH) below the moving averages. If they succeed, a drop to the uptrend line is possible. If this support also cracks, it will indicate a range-bound action for the biggest altcoin for a few more days.

Bitcoin and Ether now account for 44% of the value locked in DeFi

The recent explosive growth of decentralized finance has seen the sector lock nearly $4 billion worth of Bitcoin (BTC) and Ether (ETH) in less than five months.

According to DeFi Pulse, the number of Ether locked up in DeFi protocols increased 218.5% since June, growing from 2.7 million ETH to 8.6 million ETH. Locked Bitcoin has grown more than 3,000%, from 5,000 BTC in mid-2020 to roughly 158,800 BTC today.

OKEx Cryptocurrency Exchange Suspends Withdrawals

The OKEx cryptocurrency exchange suspended withdrawals at 11:00 UTC Hong Kong time (3:00 AM UTC). In an announcement, the exchange says that it has been “out of touch” one of its private key holders due to “investigations” conducted by a “public security bureau”:

OKEx’s issues seem to have had a negative impact on the cryptocurrency market, BTC is down 0.7% on the day, while ETH dropped by 2.5% in the last 24 hours.

Traditional markets:

Uphill Struggle. The major U.S. stock indexes climbed for the third week in a row, but at a far slower pace than in the previous two weeks, as the indexes’ weekly gains were less than 1%. Performance was choppy, as a big rally on Monday was offset by a comparably sized decline the next day.

Brexit in Jeopardy. Prime Minister Boris Johnson said on Friday that the United Kingdom will prepare to leave the European Union’s single market at year end without a Brexit trade agreement in place. Continued uncertainty over terms of the U.K divorce from the EU weighed on European stocks throughout the week, as did rising coronavirus cases.

Coronavirus Worries. Investors appeared concerned by the continued rise in cases in the U.S. and Europe, and Wednesday brought news of pauses in trials of both Johnson & Johnson’s vaccine and Eli Lilly’s antibody treatment due to possible adverse reactions.

European recovery faces “tougher phase” Per ECV’s Lane. Although the pickup in business activity would continue in the fourth quarter and next year, much would depend on the extent of localized lockdowns. He played down expectations for fresh stimulus as soon as next month, saying policymakers will wait for information on 2021 budgets, the exchange rate, and oil prices, among other factors, before deciding on a policy response.

Internet behemoths face tougher EU rules. The EU is drawing up a “hit list” of up to 20 big internet companies that would face tougher rules aimed at curbing their market power, the Financial Times reported. The targeted companies would have to comply with new rules forcing them to share data with competitors and to be more transparent on how they gather information.

China Trade Data Underscore Recovery. China’s exports last month beat market forecasts and grew for the fourth straight month, jumping 9.9% year-on-year in U.S. dollar terms, according to preliminary official data. The International Monetary Fund raised its full-year gross domestic product (GDP) forecast for China to 1.9%, up from its June forecast of 1.0%, in its October World Economic Outlook.

Philip Tam

Co-founder & CEO

Sources/Reference

OSL, coindesk, CoinMarketCap, Coincodex, Cointelegraph

John Hancock Investment, Bloomberg