Global Equity Markets in Shock

In the face of the novel coronavirus outbreaks, global equity markets experienced its largest crash since the 2008 financial crisis. During the last week of February 2020, US equities trigger trading curbs on 4 occasions, the impact of which may be greater than the crash of the 2008 financial crisis. Subsequently, governments take initiative, intervening with massive capital injections to kickstart quantitative easing. Panic selling continues to takeover global equity markets, the largest losses of which are: US (37.5%), UK (34.1%), Hong Kong (29.5%), China (16.9%).

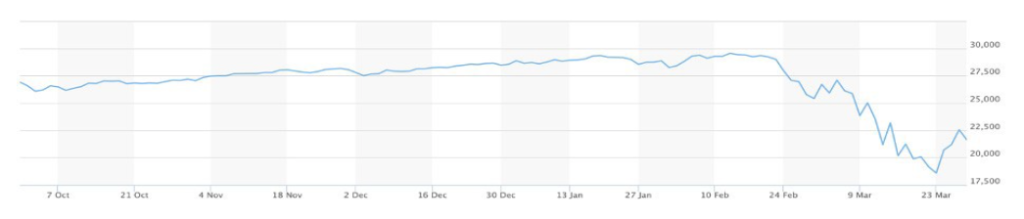

Dow Jones Industrial Average (DJI)

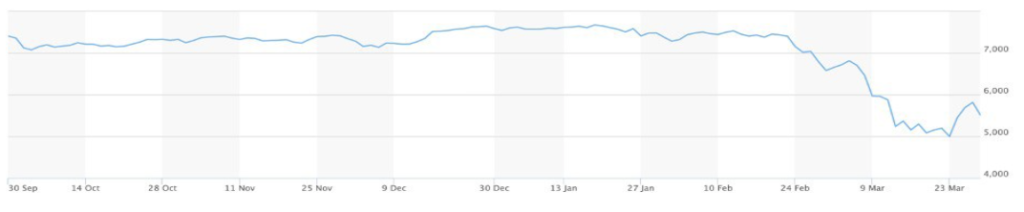

The Financial Times Stock Exchange 100 Index (FTSE)

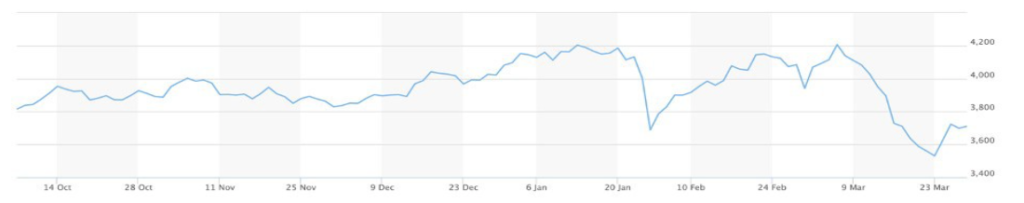

Hang Seng Index (HSI)

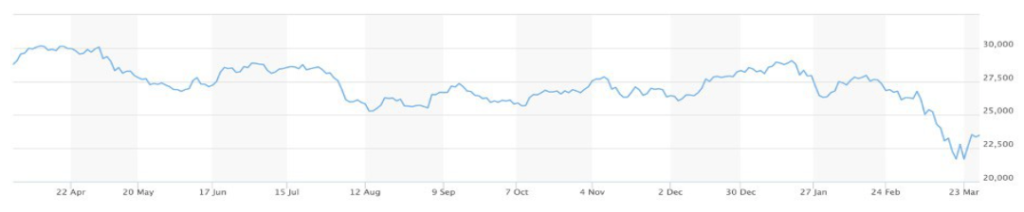

CSI 300 Index

As 3 billion people are in social isolation due to the novel coronavirus, the global oil demand may fall by 20%. In addition, Russia and Saudi Arabia are in the middle of an intense price war, causing much volatility in the crude oil market. At one instance, oil prices saw a 30% decline within a day, with the overall bottom sitting at

20.06 USD per barrel, the lowest since 2003. While the oil price fluctuations are detrimental to both countries fiscal performance, Russia views Saudi Arabia’s behaviour as extortion, and has no intention of backing down; oil prices are likely to remain at low levels.

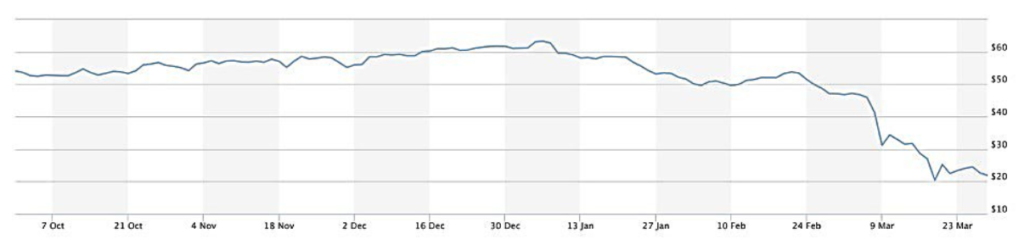

Crude Oil

The US FED suddenly cut interest rates again in less than two weeks, by 1%. The federal reserve’s target rate is adjusted lower to 0 to 0.25%, which lowered the yield on 10-year treasury bonds by 0.38%. Since US Treasury bonds have always been considered as a risk-free benchmark, this will cast doubt on the true value of more than USD50 trillion in assets worldwide. This not only impacts the bond market, but extends over to mortgag- es, municipal bonds, and emerging market debt, all of which are influenced the US debt rate.

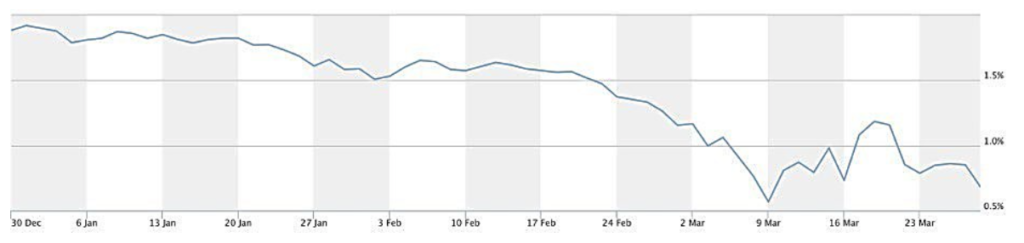

US 10 Year Treasury Bonds

Initially, the plunge in US stocks triggers substantial sell-offs of the US Dollar and the parking of its value into currencies such as the Japanese Yen and Swiss Franc. However, due to the high volume of margin calls, US Dollar cash demand surges. Concurrent with the British Pound Sterling reaching new lows since 1985, the appreciation of US Dollar heightens concerns surrounding the global credit crunch, triggering panic sell-off of stocks and other assets. Even traditional safe-haven assets such as gold and US Treasuries are under pressure. This in turn, further contributes to the US Dollar demand (the acquiring of cash to service margin calls), cre- ating a vicious circle. The strength of the US dollar indicates rising deleveraging pressure, and since the global financial crisis, the total global dollar debt has increased significantly. According to data from the Bank for International Settlements (BIS), the total amount of US dollar credit provided to non-bank borrowers outside the United States has increased from US 5.8 trillion USD at the end of 2008 to 12.1 trillion USD at the end of the third quarter of 2019. Generally speaking, the traditional financial markets, regardless of sector, are strongly correlated.

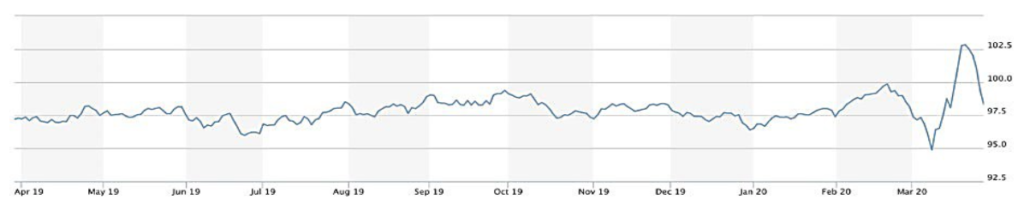

US Dollar Index

Central banks globally have cut interest rate in an attempt to stimulate the economy. However, following the interest cut of 1% by the US Federal Reserve, market panic exacerbates, unexpectedly causing gold to also plummet. The poor market sentiment is reflected in gold’s price drop of more than 3%, down to the spot price of 1456 USD at one point. Under these circumstances, it appears that even safe-haven assets cannot avoid tak- ing a loss. Despite the situation, the US has elected to deploy quantitative easing. The unconventional monetary policy will inevitably depreciate the value of the US Dollar and may even trigger hyperinflation by chance. In principle, gold should have been able to play its role in remaining a stable store of value under such circum- stances.

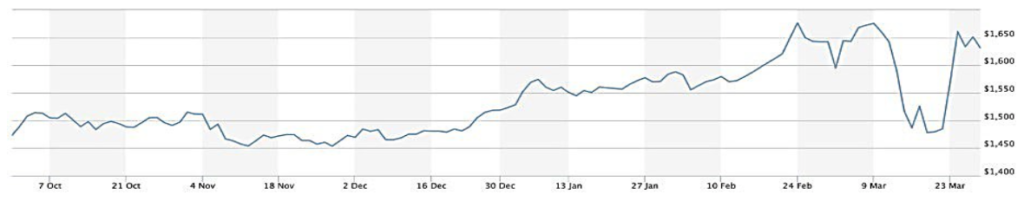

Gold

Commodities Futures

Under the looming epidemic, industrial and commercial activity stall globally. Commodities markets see slash in demand, high volume exits, rocking the commodities futures markets, including livestock, soy, cotton, corn and precious metals.

Global Economic Outlook

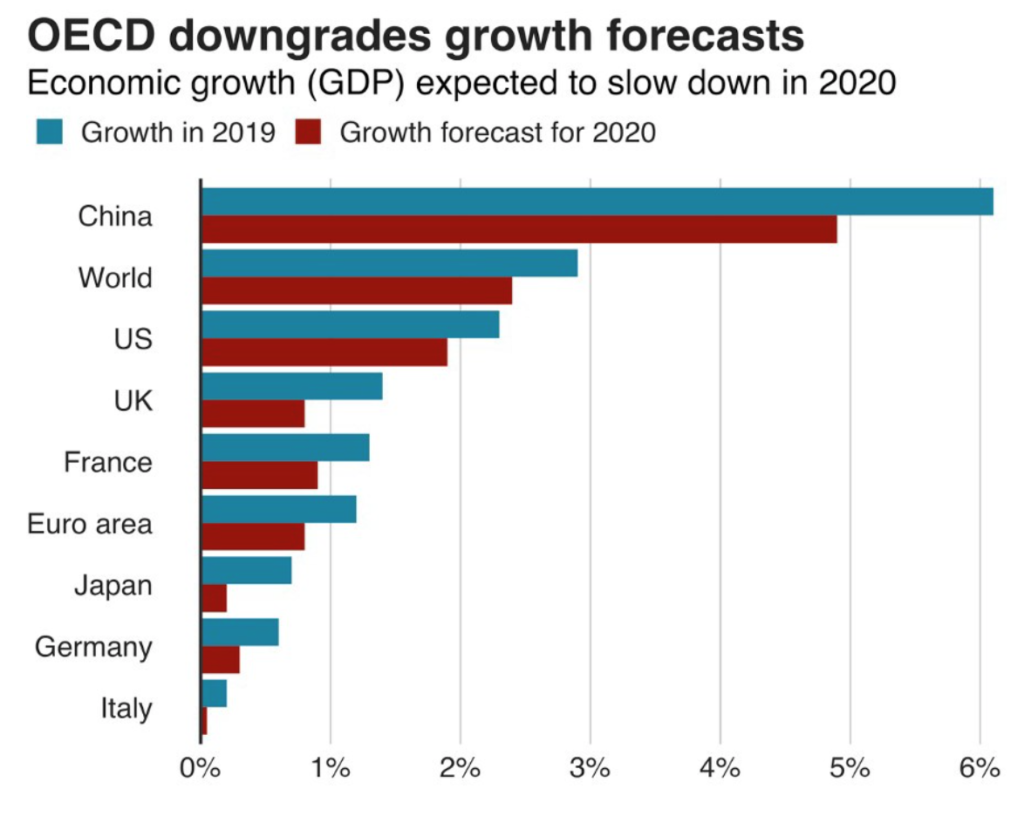

Following the US-China trade war and subsequent decline in global trade activity, the IMF forecast indicates a firm decline in global economic growth. During the first quarter of the year 2020, markets tumble globally, as the novel Coronavirus (COVID-19) disease swept across nations, bringing the global economy into recession. According to the Organisation for Economic Cooperation and Development (OECD), the global economy is poised to experience the slowest rate of growth since 2009, given such circumstances. The OECD predicts that the global economy in 2020 will see an increase of 2.4% at most, in contrast to the prior forecast of 2.9% made in November 2019. Furthermore, the intergovernmental economic organisation also pointed out that long-lasting and intensive outbreaks (which are surfacing in Europe and the US) will force production facili- ties to combat the epidemic. This type of economic activity suspension may further reduce the 2020 economic growth rate by 1.5%.

source: OECD

Whisky Market

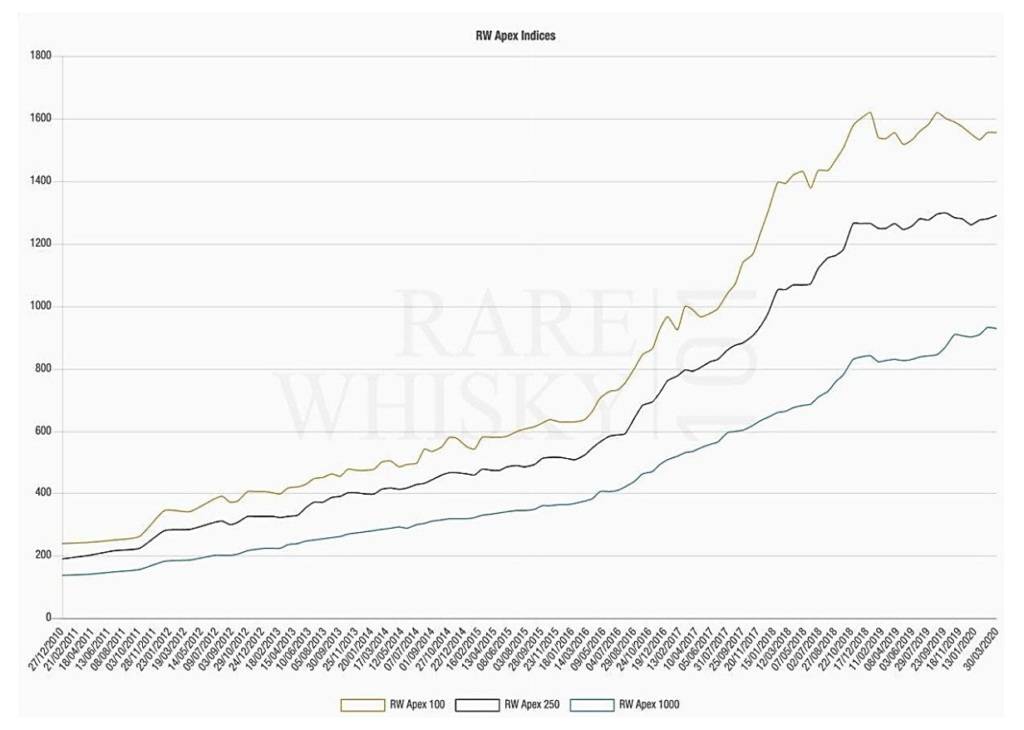

The global financial market began to decline on February 21, 2020. However, the bottled whisky market broke the macro-trend starting from February 30, 2020, onwards. While there is lag, the bottled-whisky market data reveal trends for the subsequent months tocome.

It should be noted that the whisky market is fundamentally different from conventional commodities and traditional financial markets, with little discernible correlation. In terms of price stability, this whisky cask market is more stable by nature, in comparison to the bottled whisky market. This is, in part, due to the majority of cask beings held by wealthy individuals or families (“old money”), a demographic with relatively high holding power. This also put whisky casks in the realm of alternative assets and luxury goods. Moreover, long-term demand (export) is projected to outgrow production, leading to fewer whisky casks flowing into the private market. Practically, whisky casks and bottled whiskies can be treated as separate markets. The bottled-whisky market has significantly higher liquidity and lower barrier to entry and is more price-sensitive in comparison.

Market Participants: DCI Model

Amongst whisky buyers, each has its own set of standards and criteria, driven by several key factors. The model illustrates some of the key elements behind the motivation to buy whisky.

Simply put, the pure Drinkeronly values the quality of a whisky. They are most concerned with the ability to acquire and taste whiskies that are considered by the market to be good.

Collectors are motivated by factors that are often highly subjective to personal preferences. Needless to say, some of the most coveted bottles are the limited-edition series released by notable distilleries. However, some collectors pay more attention to a single OBs (original bottler) while others are followers of IBs (independent bottlers). Some bottles, in particular, may have special meaning for certain collectors, such as a birth-year of a loved one, wedding anniversary, etc. It is also not uncommon for collectors to buy bottles with “special” serial numbers (#2, #8, #33, #88, #888, etc.) at a premium.

Investors are motivated by potential returns and pay attention to attributes such as market acceptance and rari- ty, which are key drivers for bottle appreciation. To investors, limited edition or single cask bottles are attractive buys. Usually, bottles produced by “blue chip” or “iconic” distilleries makes for a safe investment choice.

When a bottle quickly sells out and appreciates on the secondary market, it falls into the realm of the “Sweet Spot” such that it is highly attractive to all three types of buyers.

Whisky Market Outlook

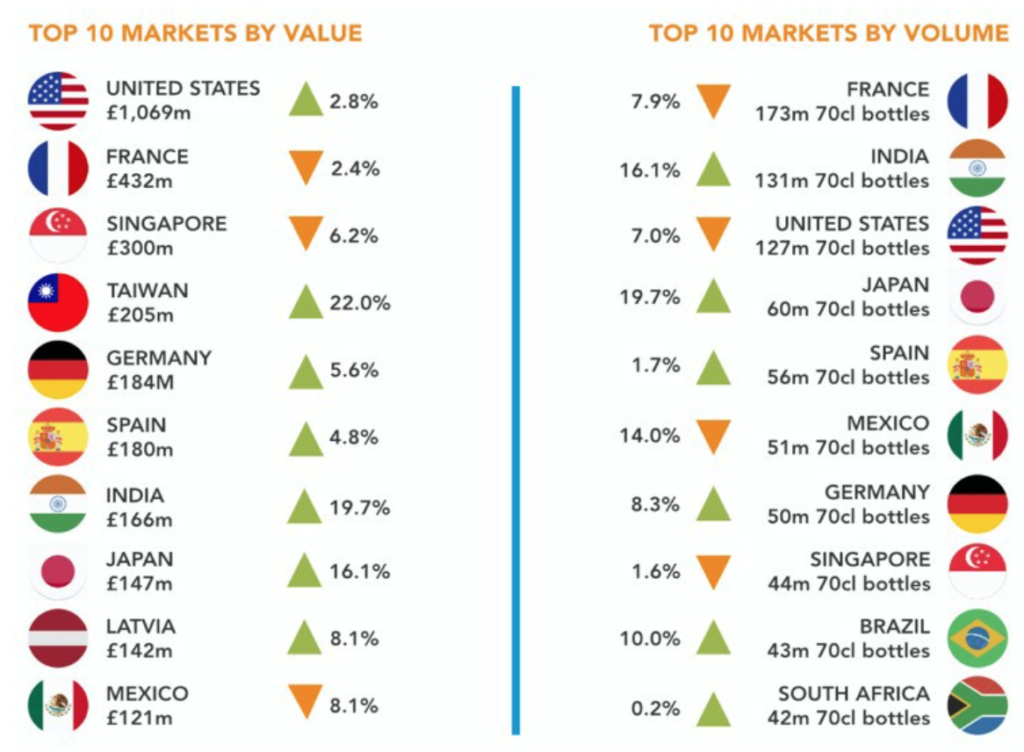

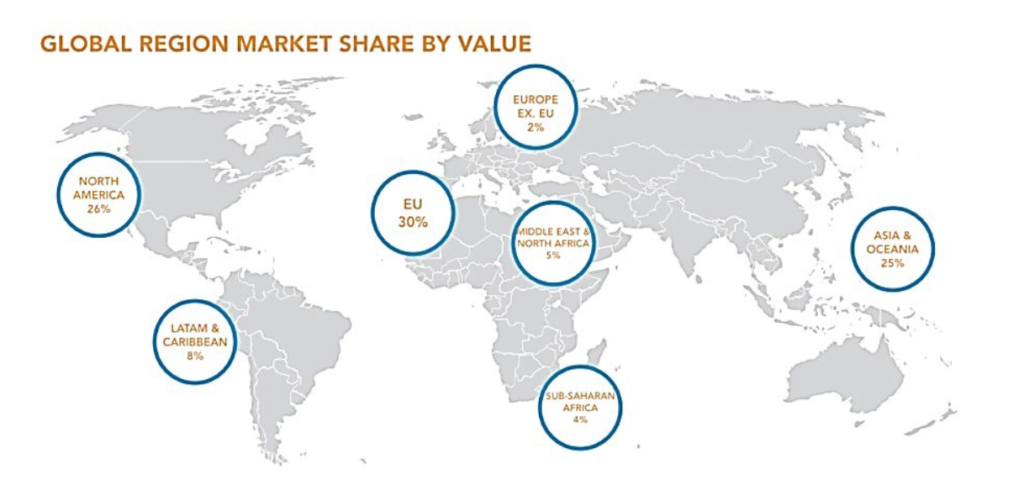

Scotch whisky exports have grown year-to-year, increasing by 128% since 2000, with a total value of £ 5 billion, reflecting the rising demand in the world market. Notably, the local production has not increased significantly (single malt whisky only accounts for 9.3% of total production). In the event of an imbalance between a steady supply and growing demand, prices will inevitably increase. Among the top ten whisky export markets, China has not yet make it onto the list, which reflects a vast potential for market expansion. In addition, Asia is the leader in world economic growth, with a current market share of only 25%. Overall, the whisky market is expected to continue to expand.

Market Watch – 15 June 2020

$BTC 24 Hour High $9,483.35

$BTC 24 Hour Low $9,347.59

$BTC -0.8%

COVID-19 continues to dominate headlines with reports of an emerging second wave, coinciding with further protest gatherings across the US and the reopening of more state and municipal economies. Punctuating this second-wave trend is the news out of China reporting 50 new cases and a subsequent lockdown in Beijing. Though the narrative has not changed much since last week, investors’ reactions have. Traditional safe havens have seen significant action. Spot gold has climbed to 1,730 highs and US 10-Year bond yields have dropped back to 0.675 from 0.95 last week.

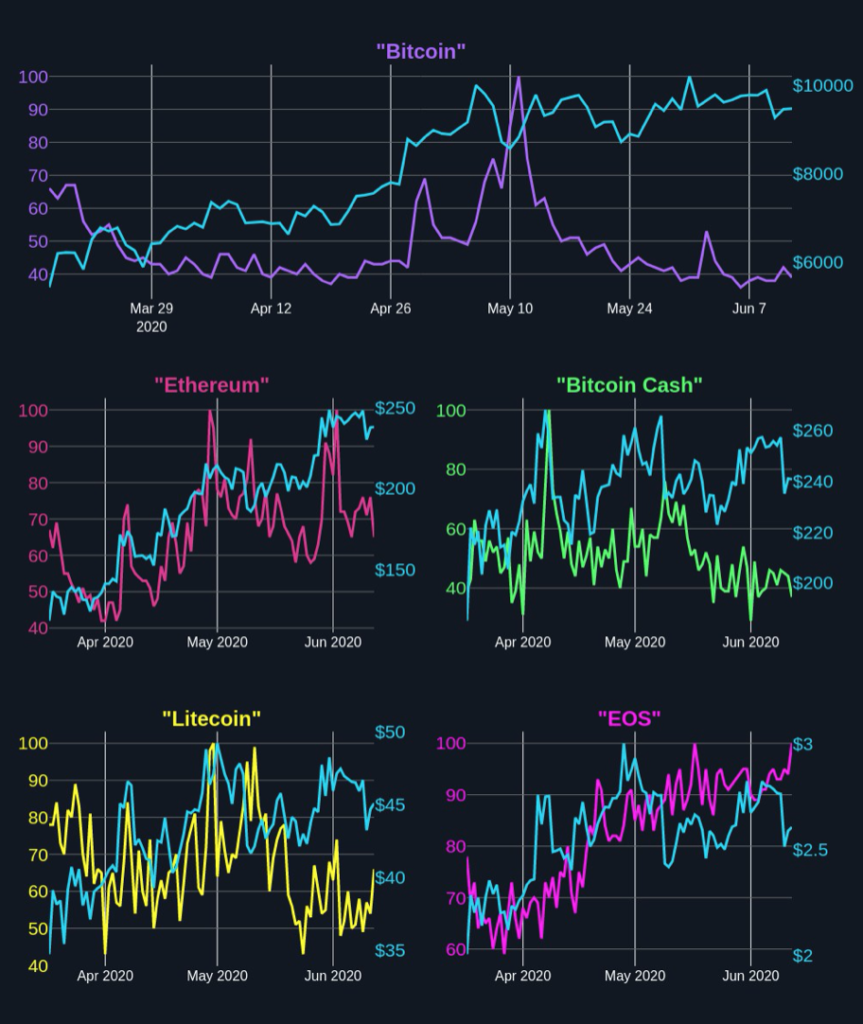

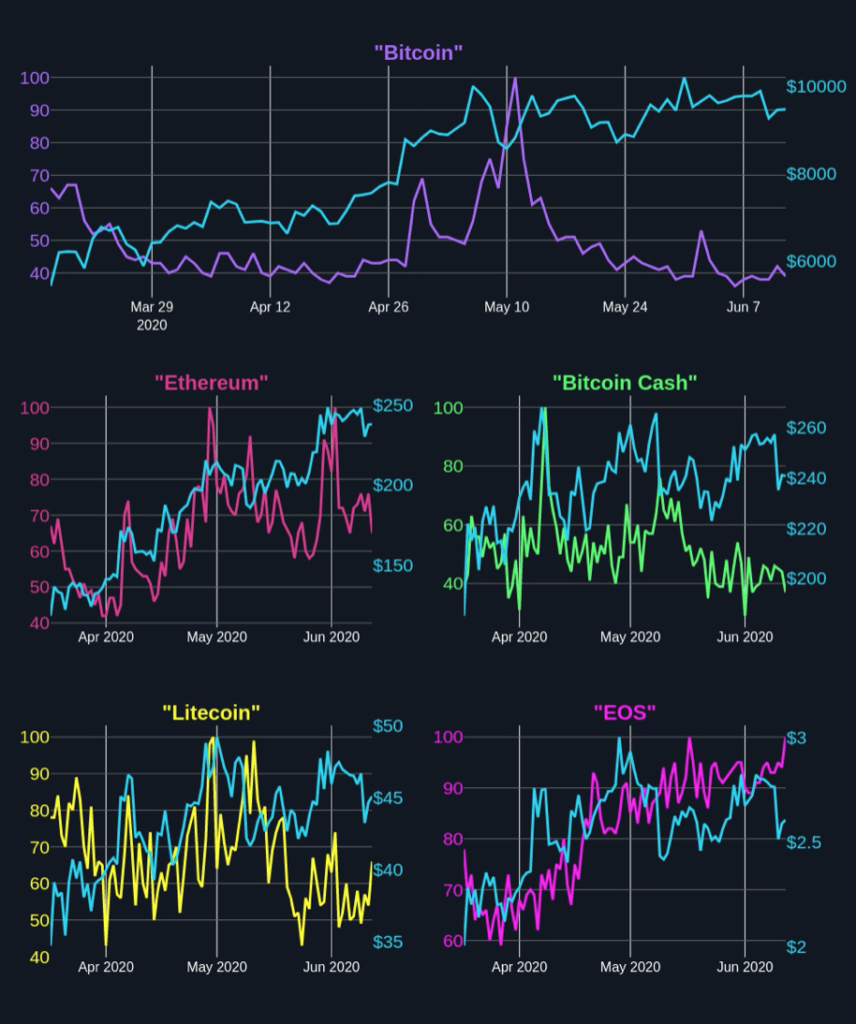

Digital assets market:

- Moves largely followed that of the equity markets with its overall market cap contracting by 2B over the weekend to start the week off at 259B.

- However, $BTC saw a flurry of newly opened wallets with 0.1 or more $BTC, as more retail investors are stepping into the space amidst the current unrests around the world, topping previous ATH by 212 to 3,054,282 addresses (#glassnode)

- $BTC traded in a tight 150 range as it tested 9,200 support levels on Saturday off low volumes

~18B. $BTC over the past week dropped -3.9%, but still up 30% YTD at 9,300 levels.

- BTC dominance at 64.9%

- $BTC futures volumes at two-month lows over the weekend, seeing ~7B volume compared to 20B highs during the peak of last week’s volatility. Open interest across top exchanges at 3.5B with 4.3M long contracts liquidated this weekend. Bull/bear ratio at 67/33.

- $ETH trading at 231 levels after shedding 3% of its Friday gains with phase one roll out for ETH 2.0 expected for sometime next month barring any major setbacks which have become the expected norm